The Second Annual Investors’ Conference on UK Mortgage Finance

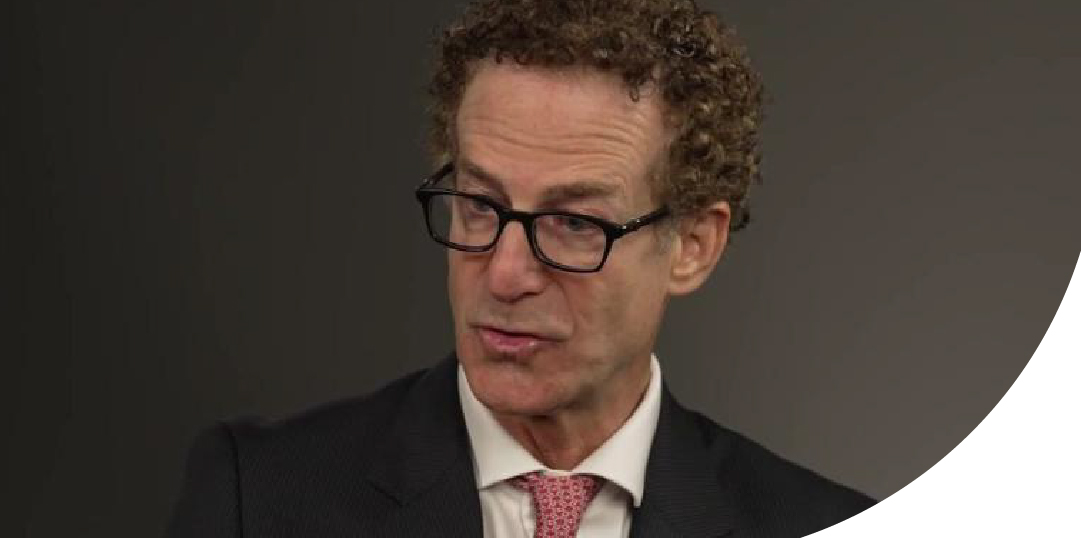

If you’re attending the DealCatalyst UK Mortgage Event on 12th September, be sure to catch our very own Theo Theodosiadis on the 2.20pm panel discussing The Future of Bridge Financing and Development Loans in the UK.