Expo Real – a must attend event

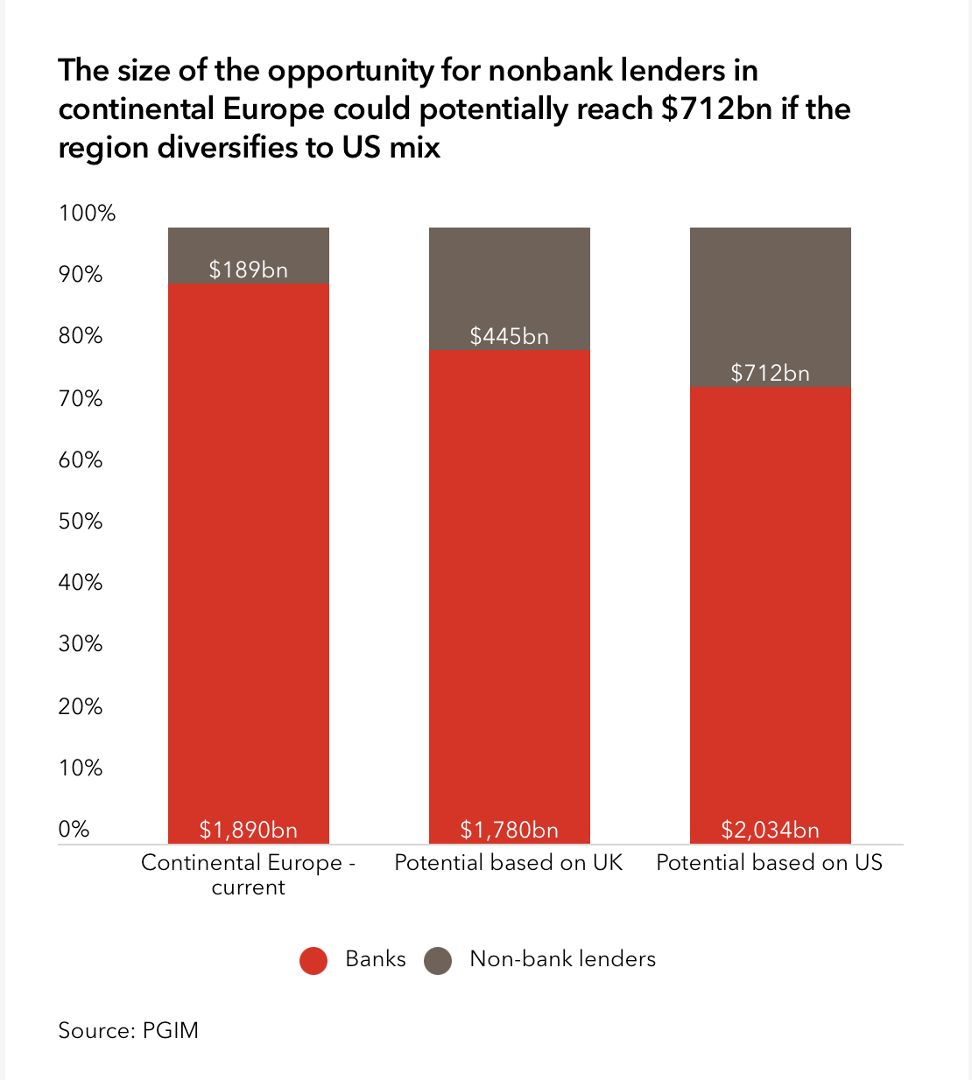

A must attend event – EXPO REAL (Messe München) last week was a great opportunity to see some familiar faces and make new connections. With concerns over rising rates and a slowdown of transactions, it was refreshing to see the upbeat mood amongst attendees with most seeing an exciting opportunity set across Europe and expectations of … Read more